ETF Portfolios

Each uniquely allocated to a specific investor profile to meet desired objectives and risk tolerance.

Theories change, principles don’t.

Protection Oriented

Target the best, plan for the worst.

Probabilities Focused

Consistent, evidence-backed, action.

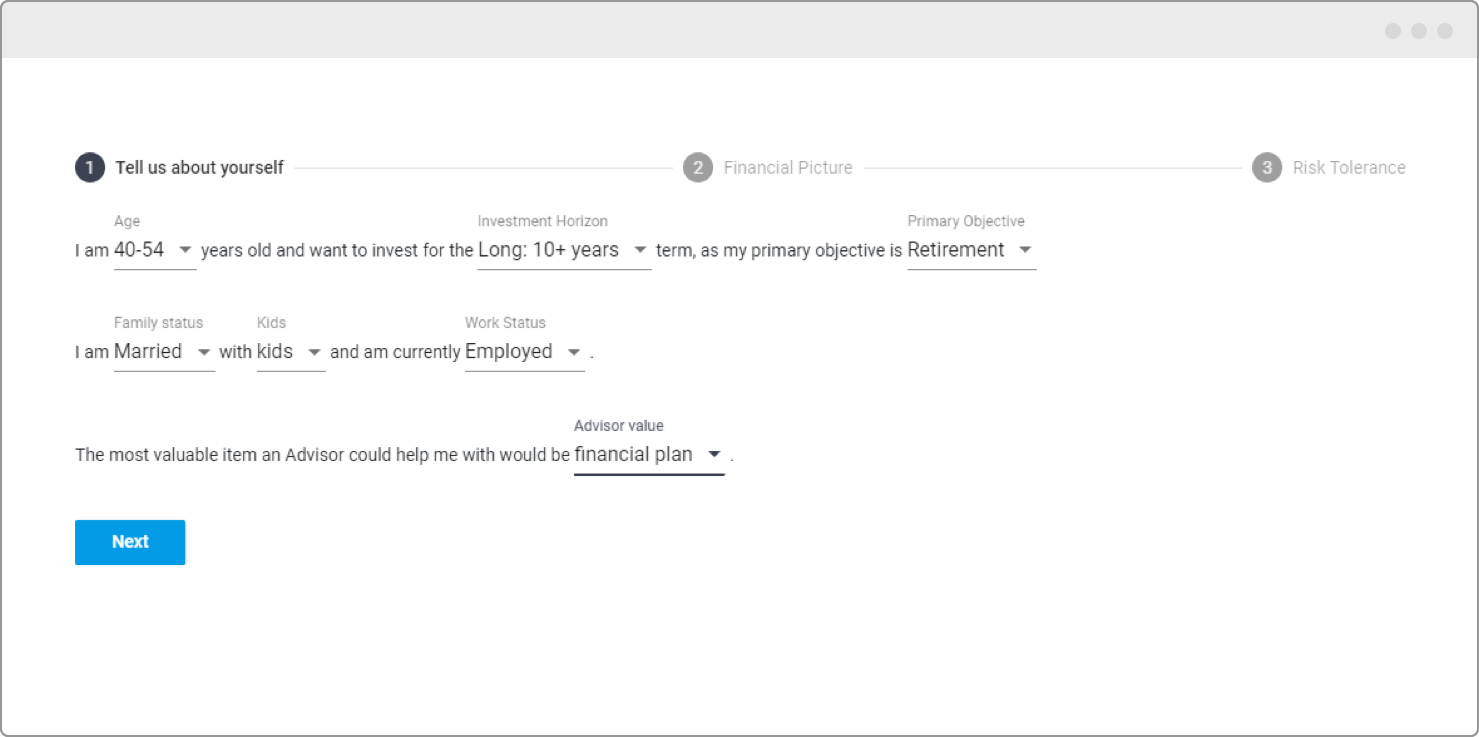

Blend Risk Tolerance and Risk Capacity

Select from six portfolio templates for your client’s core asset allocation

PRESERVE

Aenean massa. Cum sociis natoque penatibus et magnis dis aenean.

CONSERVATIVE

Aenean massa. Cum sociis natoque penatibus et magnis dis aenean.

INCOME

Aenean massa. Cum sociis natoque penatibus et magnis dis aenean.

MODERATE

Aenean massa. Cum sociis natoque penatibus et magnis dis aenean.

GROWTH

Aenean massa. Cum sociis natoque penatibus et magnis dis aenean.

AGGRESSIVE GROWTH

Aenean massa. Cum sociis natoque penatibus et magnis dis aenean.

Our Proactive Approach

Traditional diversification is not enough, a smoother path demands a proactive approach

The optimal portfolio blends return, risk, and conviction in a way that accomplishes one overarching objective – to improve investor outcomes.

We seek sufficient return while being conscious and prepared for the ever present risk that cannot be stripped from those returns. Our focus is on low cost, high quality exposure to needed asset classes with downside protection built in. All models include 3 forms of risk management:

Diversification – The only “free lunch” in town

Dynamically adjusts exposure based on trend, for protection in prolonged market downturns.

Tail Hedge- protection from extreme events in expensive markets

A Solution to Maximize Impact

It is not the exercise of investing that is important, but rather its potential impact on the things that investors value – life circumstance of the individual investor, their family, other loved ones, and potentially generations to follow.

”“ Today’s actions are creating your client’s future. “